Storing tax documents

I filed my taxes last weekend. Once that was done, I had to deal with all the supporting documentation. I don’t like to spend much time organizing those papers because I fervently hope that I’ll never have to look at them again. (The only reason I can think of that I would is if I were audited.)

So I thought I’d outline the simple way I organize my business’s financial and tax documents.

I keep January through December files in a file box on the floor under my desk. As receipts and deposit slips come in throughout the year, I put them in the appropriate folder. Every month I reconcile them in Quickbooks.

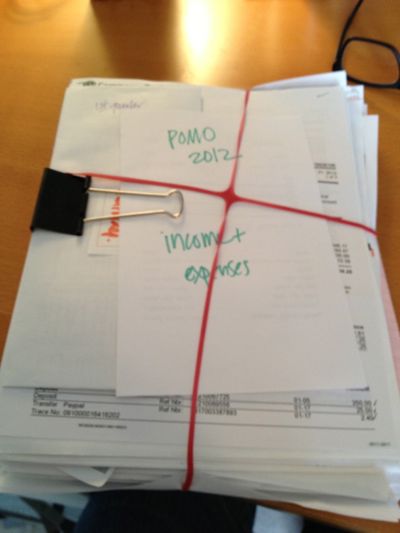

Come tax time, I don’t need to look at the pieces of paper. All the data are in Quickbooks. So once I turned my taxes in, I just pulled all the paper out of all twelve of those hanging files and banded them together with a simple label.

The nifty rubberband is from Martha Stewart Home Office with Avery.

And then I put them in a file drawer in my basement, along with my copy of the tax return and other supporting documentation for our taxes. I write off a home office, so I separate out our utility bills throughout the year in the file cabinet where we store our personal finances. I put those in an envelope and add them to the file. In seven years, I’ll pull out all those receipts and supporting documentation and shred them. I keep the 1040s forever.

This filing takes virtually no time. I have the peace of mind of knowing where the taxes are if I should need them. And they’re in the basement, out of my work space.

I’ve been doing it this way for years and so far, knock wood, I haven’t wished I’d spent more time organizing!

Tagged with: paper management, taxes

Comments

Thanks, Sarah! I’m a big believer in making things as easy as possible. They should be no more complicated than absolutely necessary!

Janine Adams April 28, 2013 09:40 AM

Links

- NAPO St. Louis

- Shannon Wilkinson, life coach

- Getting to Good Enough podcast

- Organize Your Family History

- Peace of Mind Spending

- National Association of Productivity and Organizing Professionals

- Ravelry

- Are you interested in becoming a professional organizer?

- Institute for Challenging Disorganization

Great post. Filing paperwork doesn’t have to be complex or daunting. Love the simplicity and practical application of this post. Thanks!

Sarah April 19, 2013 06:58 PM