Did you pay your quarterly taxes on September 15?

I’ve been paying estimated taxes every quarter for 25 years, since I left my full-time to become a freelance writer in 1995. After ten years writing, I started Peace of Mind Organizing in 2005. That’s 25 years of self-employment and 100 estimated tax payments. I know that they’re due January 15, April 15, June 15, and September 15. That’s been engraved in my memory for years.

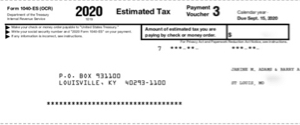

Then along came 2020. As you might recall, in response to the COVID-19 crisis, the IRS extended the deadline for tax returns, as well as estimated tax payments, to July 15, 2020. So that day I paid the first two estimated tax payments for the year. (Amazingly enough, I’d filed my 2019 taxes before the tax deadline was extended.)

This morning, I realized I’d completely forgotten the September 15 estimated tax payment. It may because I was in Walla Walla and my computer was in the shop (a one-two punch), so I was less connected to my day-to-day life. It may be because only two months, instead of the customary three, had elapsed since the last time I paid. (Although two months in 2020 feels like a lifetime.) Whatever the reason, I was a little shocked to realize that I’d let the deadline slip. And I’m making the payment today.

It occurred to me that maybe I’m not alone in this and that you could use a reminder that the estimated taxes for June, July and August 2020 were due on September 15. If you pay estimated taxes and didn’t make a payment on the 15th, feel free to join me in doing it today!

Tagged with: taxes

Comments

Links

- Shannon Wilkinson, life coach

- Peace of Mind Spending

- Are you interested in becoming a professional organizer?

- Institute for Challenging Disorganization

- Organize Your Family History

- National Association of Productivity and Organizing Professionals

- Getting to Good Enough podcast

- NAPO St. Louis

- Ravelry